A Biased View of Offshore Company Formation

Table of ContentsThe Ultimate Guide To Offshore Company FormationGet This Report about Offshore Company FormationGetting The Offshore Company Formation To WorkOur Offshore Company Formation IdeasOffshore Company Formation Can Be Fun For EveryoneOffshore Company Formation Can Be Fun For Anyone

Tax performance is the primary advantage, proprietors could also profit from reduced business costs. There are usually less lawful obligations of administrators of an overseas firm. You can likewise decide to have online office solutions that are both cost-efficient as well as they also conserve time. It is also often very easy to establish up an offshore business as well as the procedure is easier contrasted to having an onshore firm in several parts of the world.In fact, there are other jurisdictions that do not need capital when signing up the company. An offshore company can work well for numerous teams of people. If you are a business person, for example, you can develop an overseas business for privacy purposes and also for convenience of management. An overseas business can also be utilized to accomplish a consultancy company.

The Best Guide To Offshore Company Formation

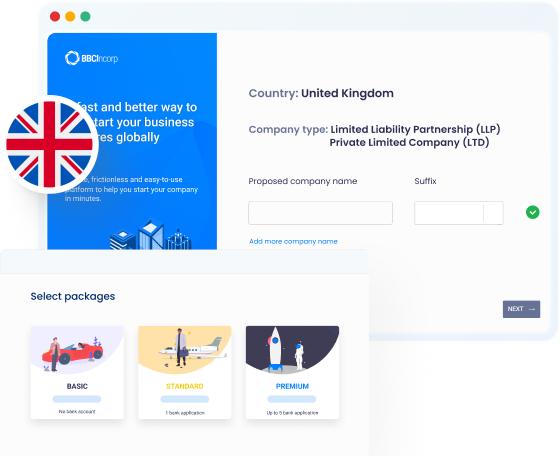

The procedure can take as little as 15 mins. Even prior to developing an overseas company, it is first crucial to recognize why you favor overseas company formation to establishing up an onshore business. Do not set up an offshore firm for the wrong reasons like tax evasion and cash laundering.

If your major objective for opening up an overseas business is for personal privacy objectives, you can hide your names utilizing candidate solutions. There are numerous things that you ought to bear in mind when picking an overseas territory.

Offshore Company Formation Can Be Fun For Everyone

There are fairly a number of overseas territories as well as the whole job of coming up with the very best one can be rather complicated. There are a number of things that you additionally have to take into consideration when picking an offshore jurisdiction. Each area has its own one-of-a-kind advantages. Some of the points that you have to take into consideration include your residency situation, your company and your financial demands.

If you browse around here established an overseas firm in Hong Kong, you can trade worldwide without paying any neighborhood tax obligations; the only condition is that you should not have a source of revenue from Hong Kong. There are no tax obligations on funding gains and investment earnings. The location is additionally politically and also economically stable. offshore company formation.

With so lots of territories to pick from, you can always find the most effective location to establish your overseas firm. It is, nevertheless, important to take notice of information when generating your selection as not all companies will certainly enable you to open up for financial institution accounts and you require to guarantee you exercise appropriate tax obligation preparation for your neighborhood along with the international jurisdiction.

The 15-Second Trick For Offshore Company Formation

Business structuring and also preparation have actually achieved greater levels of complexity than ever while the need for anonymity continues to be strong. Corporations should keep speed as well as be continuously in search of new ways to make money. One method is to have a clear understanding of the characteristics of offshore international firms, and just how they may be put to advantageous use.

An even more appropriate term to make use of would be tax obligation mitigation or preparation, because there are methods of mitigating tax obligations without find out this here damaging the legislation, whereas tax obligation evasion is normally categorized as a criminal activity. Yes, due to the fact that most nations motivate global trade and business, so there are typically no restrictions on citizens doing service or having financial institution accounts in various other countries.

Offshore Company Formation - The Facts

Advanced and trustworthy high-net-worth people and companies consistently make use of overseas financial investment vehicles worldwide. Shielding assets in mix with a Depend on, an offshore company can stay clear of high degrees of income, funding as well as fatality tax obligations that would certainly otherwise be payable if the properties were held straight. It can additionally shield possessions from financial institutions and other interested parties.

If the company shares are held by a Count on, the ownership is legally vested in the trustee, thus gaining the potential for even greater tax obligation preparation benefits. click to investigate Family as well as Safety Depends on (perhaps as a choice to a Will) for accumulation of financial investment revenue and lasting benefits for beneficiaries on a beneficial tax basis (without revenue, inheritance or resources gains tax obligations); The sale or probate of homes in different nations can become complex and also pricey.

Conduct business without corporate taxes. Tax obligation sanctuaries, such as British Virgin Islands, enable the development of International Firms that have no tax or reporting responsibilities.

The Best Strategy To Use For Offshore Company Formation

This allows the charges to accumulate in a reduced tax jurisdiction. International Companies have the same legal rights as a specific person and also can make investments, acquire as well as market realty, trade portfolios of stocks and bonds, and also conduct any type of lawful company tasks so long as these are refrained in the country of enrollment.